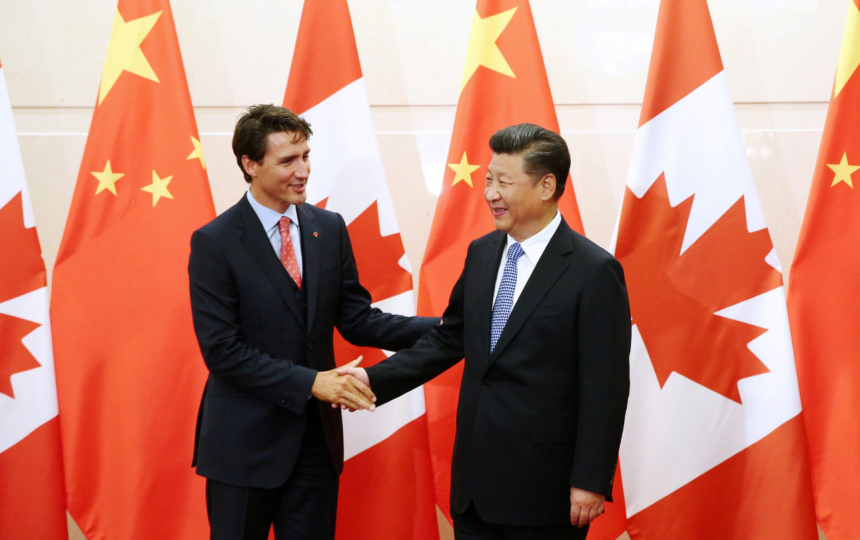

Canada is navigating a formidable economic storm as trade conflicts with China and the U.S. simultaneously intensify, placing pressure on key export sectors and creating uncertainty for farmers and policymakers alike.

1. China Escalates Tariffs, Blocking Canada’s Key Exports

In a sweeping move, China imposed a provisional anti-dumping duty of 75.8% on Canadian canola seed as of August 14, 2025. This follows earlier actions targeting canola meal and oil, effectively sealing off the Chinese market for a product that forms a significant portion of Canada’s agricultural exports.

Reuters

China justified the move by citing alleged subsidies in Canada and market distortion, while Ottawa and industry groups, including the Canola Council of Canada, called it politically motivated retaliation. In 2024, China accounted for C$5 billion of Canadian canola exports—80% of which were seed.

ReutersФинансовые НовостиВикипедия

2. Ottawa Responds with Support and Diplomacy

Facing this trade shock, Saskatchewan Premier Scott Moe is set to travel to China to seek relief for Canadian farmers and negotiate tariff relief. Meanwhile, federal Agriculture Minister Heath MacDonald has assured that the government is exploring support measures.

Reuters+1

The Government of Canada’s AgriStability program has been enhanced—raising compensation rates from 80% to 90% and increasing payment caps for 2025 to help cushion farmers from losses caused by inflation, market volatility, and now, tariffs.

Канада

3. Broader Trade War: A Dual Front with China and the U.S.

In parallel, China filed a formal dispute at the WTO challenging Canada’s tariffs on steel and aluminum, including surcharge measures against Chinese-origin goods.

Reuters

These developments underscore a broader pattern of retaliation: Canada targeted Chinese electric vehicles, steel, and aluminum last year, and now finds its own agricultural sector under siege.

Meanwhile, Canada’s government has also moved to align its U.S. tariff policy under USMCA, dropping retaliatory duties on many U.S. goods to ease tensions. However, tariffs on steel, aluminum, and autos remain.

AP News

To mitigate dependency risks, Prime Minister Mark Carney is heading to Germany to deepen economic and resource ties, especially in critical minerals and clean energy.

Politico

4. Economic Fallout and Sectoral Strain

- Agricultural sector: Canola tariffs could jeopardize an industry valued at C$43 billion and employing over 200,000 people.

ВикипедияReuters - Trade disruption: Products like canola oil, peas, and pork—totalling nearly $2.9 billion in exports—now face significant hurdles.

РБКAP News - Supply chain vulnerability: Disruption in agri-exports may reverberate through logistics, finance, and rural communities, deepening economic stress.

5. The Takeaway: High Stakes, Urgent Strategy

Canada’s agriculture sector is at the epicenter of a trade conflict with severe consequences. With China’s retaliatory tariffs effectively blocking major export routes, and continued pressure from the U.S., a strategic response is vital.

Key actions underway include:

- Immediate relief via improved AgriStability payouts

- Diplomacy: Negotiations led by provincial and federal officials, including a direct mission to China

- Diversification efforts: Expanding partnerships beyond China to markets like the U.S., Japan, and the EU

- Trade realignments: Refreshing trade deals and reducing reliance on single markets